November – 2020

“Stock Market Checklist“

The markets in 2020 have been defined by COVID-19, or the coronavirus. Centered around the markets and their performance has been the restrictions to the economy in order to contain the virus, and the timeline of reopening and the reengagement of activities that were part of our lives pre-COVID. As restrictions around social distancing carry significant impact to our daily lives, a concentrated focus has been on our ability to treat or vaccinate COVID-19 and the timeline of implementation. Yesterday, the world received significant news via the Pfizer/BioNTech vaccine announcement, and we felt it was prudent to update on the status of COVID vaccinations as well as our adjustments considering recent events.

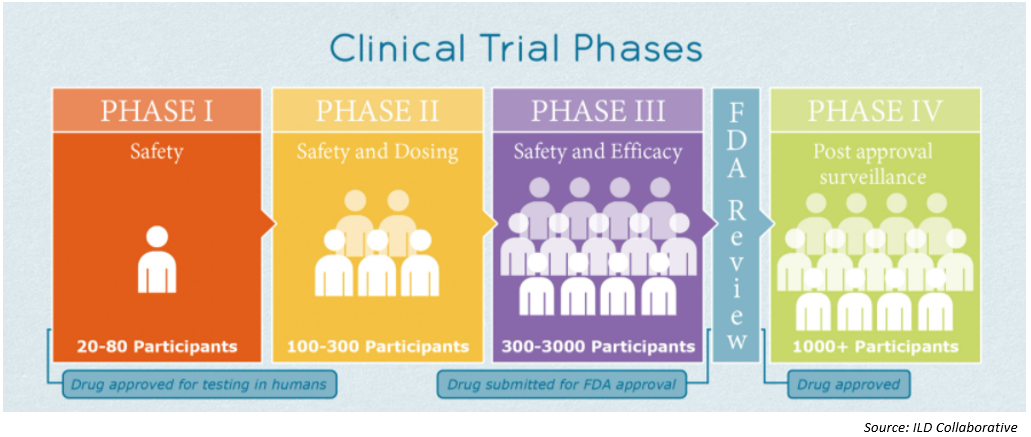

As of November 3, there were 47 COVID-19 vaccine candidates in clinical evaluation – nine in Phase III clinical trials – and 155 in preclinical evaluation1 according to the WHO website. The picture below describes the various phases of a clinical trial2.

Vaccines, from preclinical trial to adoption, typically require years of research and patient testing before patient use. On Monday November 9, however, Pfizer and BioNTech delivered initial Phase III data that indicated their COVID-19 vaccine was over 90 percent effective. This was the first vaccine to have such an indication and caused the market to have a very favorable reaction.

As an example of the strength of initial efficacy, according the interim data released by the CDC, the flu vaccine for the 2019-2020 season has been 45% effective against influenza A and B viruses (50% effective against influenza B and 37% effective against influenza A)3. With the COVID-19 vaccine at 90% efficacy on the initial update from the Phase III trial period, this could mean a quicker transition to a “herd immunity” as more people may be willing to take the vaccine based on the high level of effectiveness.

Pfizer and BioNTech are expected to release further data in late November with potential for Emergency Use Authorization and production beginning in December. Currently, the firms intend to produce up to 50 million doses by the end of 2020 and up to 1.3 billion doses by the end of 2021. However, challenges remain in getting the vaccine to patients include:

- Limited production capacity

- Two doses are required per patient

- Vaccine needs to be “cold-stored” at minus 94 degrees Fahrenheit from bottling to injection

The CDC and HHS are working with local governments to create logistics plans for wide levels of application as quickly and safely as possible. However, it should be noted that the first available doses will likely be administered to front line workers such as health care employees, first responders, and high-risk patients like the elderly in nursing homes.

Although the recent announcement was extremely positive news, we are not out of the woods yet. We continue to face distribution challenges for the vaccine, lack of production to meet demand, and a current virus situation that has been worsening. Further, we await future data from the Pfizer study, as well as studies from other pharmaceutical firms in their efforts to build vaccines. If we achieve multiple vaccine successes, it would create further benefit by increasing production levels for a quicker response to global demand. A vaccine, which could be approved by the FDA at the end of November, would be an optimistic signal to support an economic recovery, which was reflected in the large stock movement on the Monday news.

At Gradient, we will continue to monitor the economic landscape and allocate portfolios accordingly and opportunistically. As an example, we made a tactical decision to re-deploy cash at the end of October in our Gradient Tilt Series, based on the October correction in the markets that allowed us to invest in portfolios we felt are advantageous. As markets are shifting aggressively, we will remain diligent in looking for opportunities to add value while remaining prudent in our risk-managed processes.

Advisory Services offered through Cooper Financial Investments, LLC. Insurance services offered through Cooper Financial Group, LLC, an affiliated company. Cooper Financial Investments, LLC and Cooper Financial Group, LLC are not engaged in the practice of law. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. The information contained herein is not an offer to sell or a solicitation of an offer to buy the securities, products or services mentioned, and no offers or sales will be made in jurisdictions in which the offer or sale of these securities, products or services is not qualified or otherwise exempt from regulation. The information contained in this material have been derived from sources believed to be reliable, but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed.

Whenever you invest, you are at risk of loss of principal as the market does fluctuate. Past performance is not indicative of future results. Purchases are subject to suitability. This requires a review of an investor’s objective, risk tolerance, and time horizons. Investing always involves risk and possible loss of capital. Cooper FInancial Investments, LLC is not affiliated with Gradient Investments, LLC.